In the competitive real estate market, stabilizing rental income requires proactive strategies. Identify and address vacancy hotspots by analyzing occupancy rates and targeting marketing or renovations. Optimize pricing based on local demand, amenities, and economic trends, with dynamic pricing during slow periods. Implement robust tenant retention programs focusing on positive experiences, prompt issue resolution, and long-term incentives. Leverage technology for enhanced communication and satisfaction to minimize vacancies and ensure consistent rental income.

In the competitive real estate market, minimizing vacancies and stabilizing rental income are paramount for investors’ success. This comprehensive guide explores three powerful strategies to achieve these goals. By identifying and addressing vacancy hotspots in your portfolio, optimizing rental pricing to maximize occupancy, and implementing effective tenant retention programs, you can enhance profitability and ensure a steady cash flow. Discover actionable insights that will revolutionize your real estate investments.

Identify and Address Vacancy Hotspots in Your Portfolio

In the real estate market, identifying and addressing vacancy hotspots within your portfolio is a strategic move to stabilize rental income. Start by analyzing occupancy rates across all properties; pinpoint areas with consistently high vacancy levels. These hotspots could be due to factors like location, property age, or lack of amenities. Once identified, address these issues through targeted marketing campaigns that highlight the unique features of these properties, or consider renovations and upgrades to make them more appealing to potential tenants.

For instance, if a particular neighborhood is experiencing high turnover rates, refresh your listings with modern images and descriptions, emphasizing proximity to local attractions and amenities. Alternatively, older buildings might require significant renovations to meet current standards; investing in updating kitchens, bathrooms, and common areas can significantly improve tenant interest and reduce vacancy.

Optimize Rental Pricing Strategies for Maximum Occupancy

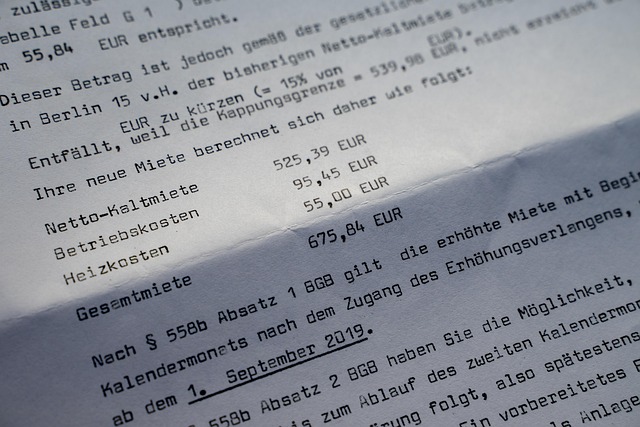

In the real estate market, optimizing rental pricing strategies is a powerful tool to attract tenants and maximize occupancy rates. A key approach involves conducting thorough market research to understand area demand. By setting prices competitively within the local landscape, landlords can either entice new tenants or retain existing ones, thereby reducing vacancies.

Real estate professionals should consider factors like property amenities, neighborhood desirability, comparable rental units, and current economic trends. Dynamic pricing strategies, such as seasonal adjustments or offering incentives during slower periods, can also stabilize income. This involves a nuanced understanding of the target demographic and their needs to ensure the property remains appealing throughout the year.

Implement Effective Tenant Retention Programs

In the real estate market, minimizing vacancies and securing consistent rental income are key strategies for investors. One effective approach to achieve this is by implementing robust tenant retention programs. By focusing on retaining existing tenants, landlords can reduce turnover rates and minimize the time and costs associated with finding and moving in new renters.

These programs should aim to foster positive living experiences, address tenant concerns promptly, and offer incentives for long-term commitment. Regular communication, maintenance response, and community engagement are essential components. Landlords can also leverage technology to stay connected with tenants, provide digital services, and offer personalized experiences, all of which contribute to higher tenant satisfaction and retention rates in the competitive real estate market.